Ticker: COH

Market Cap: $15.4B

Shares Out: 367M

F P/E Ratio: 20.95

EPS: 1.37

Price: $38.61

Coach continues to drive ahead up over 3% today after a report released from Reuters last night and again this morning predicted very strong christmas sales this year. I wanted to purchase the stock in the mid 30's but it took too long to get 'approval' for it from my company. It can take upwards of a week to get approval from the investment staff. So, by the time I got approval, the earnings had been released and i could only get in at 38.41. With the stock up to 41.80, I have made a nice 8.8% in just a few weeks.

My analysis is based on the valuation model below. I forecast a slightly conservative 14% average revenue growth rate from 2008-2011, decreasing to 8% thereafter and a terminal growth of 3.5% Also, EBITA is conservative as well with the margin decreasing over 300 basis points over the course of 4 years.

I think this is extremely conservative givin the expansion opportunities and new products that will be coming out over the next few years. Operating profits have been growing at over 50% annually for the last 5 years- a streak unlikely to continue. However, I believe most analysts are underestimating their top line growth. Conceivably, I would imagine top line growth to average between 17-19% over the next 5 years.

Coach has had tremendous US growth over the past 5 years or so. However, the new growth driver will be Asia where they are broadening their presence in Japan and expanding into China. They plan on adding another 35 stores in the U.S. and between 15-20 in Japan, where they completed the purchase of Coach Japan last year. 20% of sales are being converted into free cash flow.

The firm does have its risks in that the high end retail market is extremely fickle and with new products coming onto the market each season, the chance that Coach will be out of style would have disastrous effects on the top line estimates.

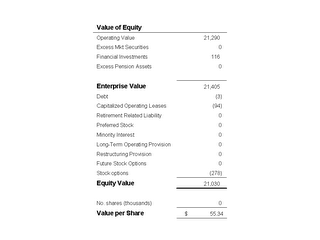

My model gives the firm a $20B+ market cap giving an implied share price of $55.34; a 30.9% upside potential off the $42.30 quote as of 3:40pm today.

Below is a simple check model that i do after completing the more complex to make sure I'm not way off the mark. I use Thomson Baseline or First Call to find the estimated 5 year EPS growth rate average and enter it into the model along with the current years EPS. I then estimate the P/E 5 years from now either using the drivers above or historical industry P/Es. This give me an estimated stock price.

Disclaimer: I am currently long shares of Coach (Coh).

No comments:

Post a Comment